How Nigeria Can Check Tax Fraud, Terrorism Financing Through Beneficial Ownership Reporting

Beginning from January 1, 2020, the Extractive Industries Transparency Initiative (EITI) requires all implementing countries to ensure that all oil, gas and mining companies that apply for, or hold a participating interest in an oil exploration and production asset or contract in their countries publish the names of their real owners, otherwise known as Beneficial Owners (BO).

Politically exposed persons are also not exempted from being listed; the EITI requires that any politically exposed persons holding ownership in oil, gas and mining projects must be publicly identified as beneficial owners.

The information must be made available through public registers, the EITI recommends, stating that at a minimum, the information must be published in the country’s EITI Report.

Beneficial ownership reporting in simple terms is the statutory or regulatory requirement demanding disclosure of beneficial ownership information. A beneficial owner is defined (in respect of a company) to mean a person(s) who directly or indirectly ultimately owns or controls the company or controls the benefit of a transaction – even if he does not control the company with which the transaction is executed.

According to the EITI, a BO can also be an individual who does not necessarily have an ownership stake in the company, but benefits economically from the company’s activities through other agreements, and can as well be an individual who controls the company through means other than formal ownership stakes or voting rights. It also includes an individual who holds a certain number of shares or voting rights in a company.

By implementing a BO reporting system, a country is able to achieve financial transparency, accountability and public financial management. It also empowers a country to fight corruption, bribery and money laundering as well as combat tax evasion and terrorism financing.

As a member of the global EITI, Nigeria is expected to meet the January 1, 2020, deadline set by the EITI for all implementing countries to establish a BO register. In any case, aside from being a requirement of the EITI, as an extractive revenue dependent country it is in the utmost interest of Nigeria to establish a BO register in view of the benefits the initiative holds.

In order therefore, to create awareness, build consensus and ensure that Nigeria meets the deadline, the Nigerian Extractive Industries Transparency Initiative (NEITI) has held several consultative meetings with various stakeholders including government, companies and civil society groups with support from FOSTER.

According to Dr Orji Ogbonnaya Orji, Director of Communications and advocacy at NEITI, Nigeria is optimistic about meeting the EITI deadline. Orji told e360 that NEITI has moved ahead, and is committed to include beneficial owners in its audit reports from January 2020, stating however, that the country is set to launch a BO register by October this year.

“Nigeria was seen as a model in the just concluded EITI Conference in Paris. I and the Executive Secretary (Waziri Adio) spoke extensively about Nigeria’s preparations towards establishing a BO register. We are working closely with partners in the Open Government Partnership (OGP), the Nigeria Mining Cadastre Office (MCO), Department of Petroleum Resources (DPR) and companies to meet the October timeline,” Orji told e360.

On the importance of a BO register to Nigeria, Dr Orji explained that it is required to build public trust; for citizens to know who owns what in the extractive sector and put an end to speculations and mistrust. He added that it is helpful in tracing illicit financial transactions from oil rich countries to other jurisdictions, as well as essential to check terrorism financing.

Beneficial Ownership draft register

“Insurgents in Nigeria and other oil rich countries carry sophisticated weapons, sometimes even more sophisticated than that of security operatives, where do they get funding to acquire such? Some of those funds are believed to come from extractive revenue, so BO register can help check such,” Orji stated.

Meanwhile, although companies have expressed commitment to, and support for beneficial ownership disclosure, they have highlighted absence of legislation that compels BO disclosure, potential overlap of responsibilities and conflict amongst government agencies and limitation of exploring opportunities in existing legislation as some major challenges to the initiative.

Faulting these concerns, Faith Nwadishi, Nigeria’s representative on the EITI Board, said under normal circumstances there needn’t be any law compelling compliance.

“Under normal circumstances there’s actually no need for any law to compel compliance with providing information on a company’s beneficial owners where people are ready to be transparent. It is only because they prefer to use proxies and hide their true identities,” Nwadishi told e360.

She added however, that given Nigeria’s peculiar situation, it would be good to have a law to give backing to the initiative, noting that the CAMA act is presently being reviewed for that purpose.

According to her, establishing a BO register in Nigeria would help address speculations on who owns what oil assets in the country and to know who to hold responsible for issues emanating from those assets.

Furthermore, Nwadishi explained that the BO register when fully operational will also look at issues related tax evasion and contract transparency. She expressed the hope that the register would be properly managed and updated by the authorities in charge in order for Nigeria to get the full benefits the initiative has to offer.

President Muhammadu Buhari

Also speaking on how to overcome the pushbacks relating to the establishment of a BO register in Nigeria, Mr Nduka Ikeyi said there is need to engage more with companies to assuage suspicions and also for the pronouncement of incentives that will encourage voluntary BO declaration by companies.

Speaking recently at a BO implementation session in PortHarcourt, Ikeyi also emphasised the need to engage with relevant government agencies on the establishment of the BO register and to guide against the risk of the information being used by agencies of government to target politically exposed persons who would be captured.

While calling for the deployment of an appropriate technology to facilitate real time publication of BO information, he emphasised the need to build on existing regulatory framework by way of regulations to ensure compliance by 31 December 2019.

On concerns of the absence of legislation to compel BO disclosure raised by companies, Ikeyi stated that there was existing regulatory framework which provides sufficient basis for enacting a legal regime for mandatory BO disclosure in the oil, gas and mining sectors.

“The Petroleum Act enables the HMPR to make regulations (a) prescribing anything requiring to be prescribed for the purposes of the Act, (b) providing generally for matters relating to licences and leases granted under the Act and operations carried on thereunder, and (c) prescribing forms to be used for the purposes of the Act (s. 9),” he said.

“The Minerals and Mining Act enables the HMSMD to (a) register and keep records of all enterprises and companies established and pursuing activities in mineral resources and allied projects, and (b) make regulations in respect of any matter required to be prescribed by regulations under the Act and generally for giving full effect to the provisions of this Act, including prescribing, amending or withdrawing any form that may be required under this Act (ss. 4 and 21,)” Ikeyi added.

Also weighing in on the subject matter, Executive Director of Civil Society Legislative Advocacy Centre (CISLAC), Auwal Musa Rafsanjani, told e360 that a BO register will help put an end to instances where public officials who are BO of companies use their positions to influence contract awards to their companies, undermine due process and filter money to other countries at the detriment of the Nigeria.

“Some transmit public assets to personal use, we need to know who owns what so that these irregularities will be minimised, and the incidence of corruption and tax evasion, reduced.” He told e360.

He also opined that in the absence of a legislation, government can run a BO register on the strength of existing policies or executive order, noting however, that having a legislation on BO will be best to ensure adequate compliance.

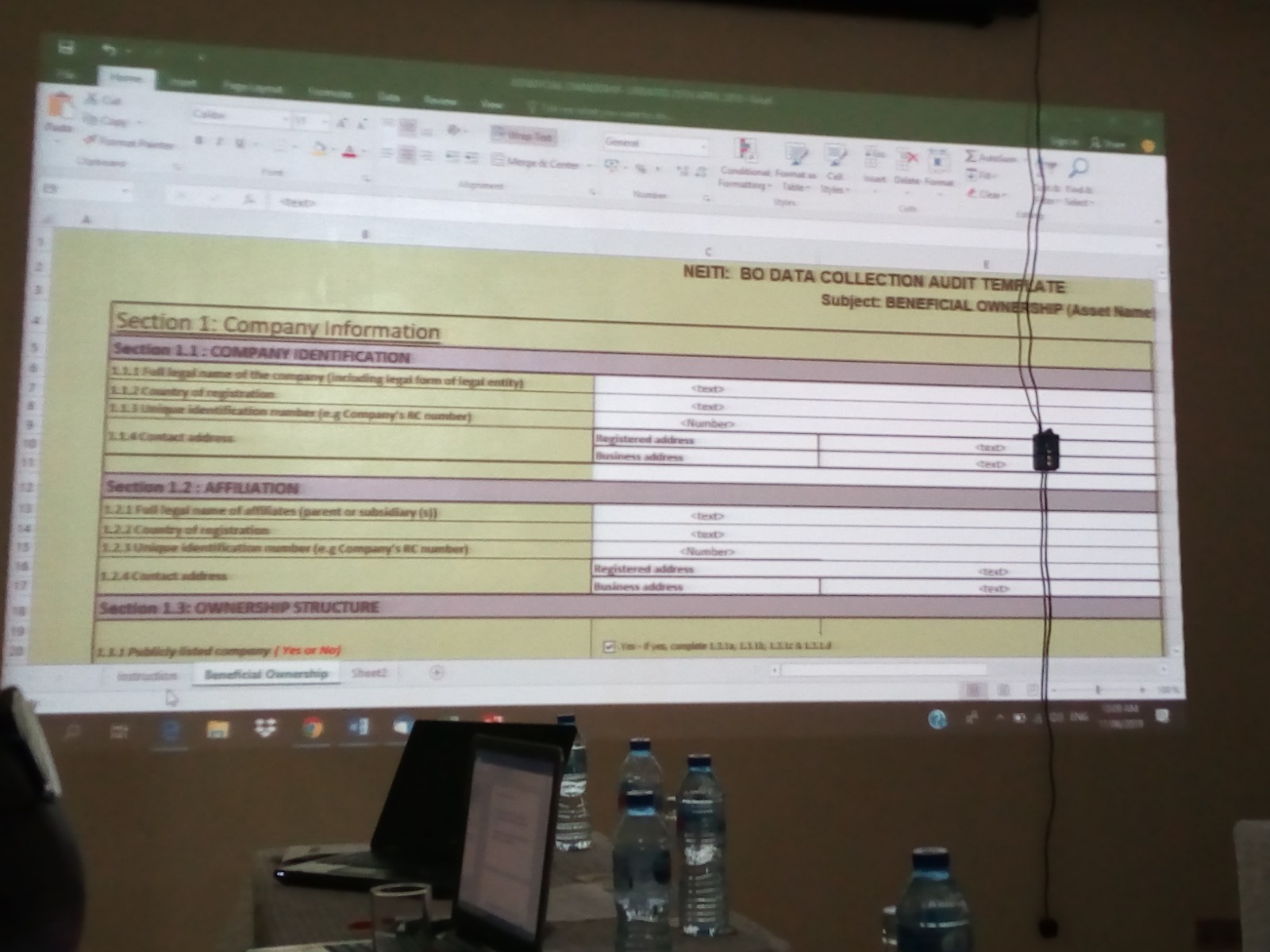

In a recent BO reporting network engagement conveyed by NEITI in PortHarcourt, with support from FOSTER, e360 learnt that the BO template being developed require anyone with 5percent and above shares in oil an oil and gas extracting company to be captured as a beneficial owner. The DPR will host register for the oil and gas companies while the MCO will host the register for the mining companies.