Nigeria And The Imminent Fiscal Implosion

In the face of current realities, the Nigerian government must take quick steps in reforming the oil sector, transit to a sustainable revenue source and eventually diversify away from oil, without which the economy will remain subject to economic shocks leading to poorer public and debt crises writes e360

The impact of the Coronavirus outbreak on Nigeria’s revenue is yet another reminder of the country’s failure to over the years save, and diversify its economy away from oil; leaving it susceptible to price fluctuations shocks.

As it were, Nigeria currently makes less revenue from the oil and gas sector due to unchecked leakages and prevailing ineffective fiscal regime. The government – both federal and states – is now predisposed to borrowing to fund revenue gaps. The situation have become worse as the world braces for a financial meltdown due to the coronavirus outbreak.

As of Wednesday, oil traders were struggling to find buyers for 55 Nigerian crude cargoes as demand from China and Europe dampens. According to Bloomberg, about 70percent of April loading cargoes from Nigeria have yet to find buyers. This is a marked decline from the normal pace of sales. No one can tell how long the situation will last, or how worse it could get.

For the states which depends entirely on federation allocations, the situation is now dire. Unless urgent steps are taken to improve internally generated revenue at the states level, or diversify the federations revenue sources to improve allocations, a collapse is imminent

In a report analysing the 2019 allocations to the tiers of government, the Nigeria Extractive Industries Transparency Initiative (NEITI) reported that all Nigerian states were in fiscal distress; unable to fund their budgets on allocations from the Federation Accounts Allocation Committee (FAAC).

More worrisome is the finding that net FAAC disbursements combined with the state’s IGR was not sufficient to finance the budget of any state without recourse to borrowing.

An analysis of the report showed that the sum of N8.15 trillion was shared between the Federal, States, Local Governments and other statutory recipients by FAAC in 2019. The 2019 figure is N377billion or 4.42percent lower than the 2018 figure of N8.524trillion, but N1.728trillion or 26.92percent higher than the total disbursements of N6.419trillion made in 2017.

Out of this amount, the Federal Government received N3.37 trillion, representing 41.4percent of total disbursements, the 36 states got N2.761 trillion or 33.9percent, while the 774 local governments shared N1.649 trillion or 20.2percent of the total disbursements.

The report showed that not even the 13percent derivation to Niger Delta states, which saw them receiving amounts widely higher than what was received by other states, could set them apart in terms of fiscal sustainability.

For example, while Osun and Cross River states have the lowest allocation of N24.14billion and N36.22Billion respectively in 2019, Delta State received the highest disbursement of N218.58 billion. “Put differently, if we assume that the net disbursements received by both states were fairly constant, then, the amount received by Delta State in 2019 alone can be used to cover disbursements to Osun State in nine years”, NEITI stated in the Report. Yet the state cannot independently fund its budget.

A further analysis of the report showed that in 21 states of the federation, Net FAAC disbursements alone could not even service their recurrent expenditure. When the research compared the total revenue accruable to each state of the federation to the state’s budgets, it concluded that “Even with the addition of IGR to FAAC disbursements, no state can independently finance its budget. Thus, all states would be faced with the option of either not fully implementing their budgets or borrowing to achieve this.”

The situation is made more precarious now following dwindling revenue as the oil market is being battered by Coronavirus, contrary to what NEITI termed “positive projections for 2020” after reviewing and comparing crude oil prices between January 2015 and December 2019 and summed that available data suggests that oil prices in 2020 will experience slight increase over the 2019 figures.

NEITI had also anticipated in the report that with increased efforts and collaboration between Organization of Petroleum Exporting Countries (OPEC) and other major oil producers to stem falling oil prices, it is hoped that oil prices will not fall further, and this will result in increased revenue for the Federation, and ultimately boost FAAC disbursements in 2020. Unfortunately, the Coronavirus outbreak has punctured a hole in the global oil market which industry watchers doubt that OPEC can fix.

OPEC on Thursday slashed its 2020 oil demand forecast due to coronavirus outbreak and recommended further production cut of 1.5 million barrels per day in the 2nd quarter of 2020 in an attempt to prop up prices, while also rolling over the existing cuts of 2.1 million bpd which was to expire this month until the end of 2020. But The recommendations fell apart on Friday as Russia’s failed to agree to deal, resulting to a free fall of oil prices.

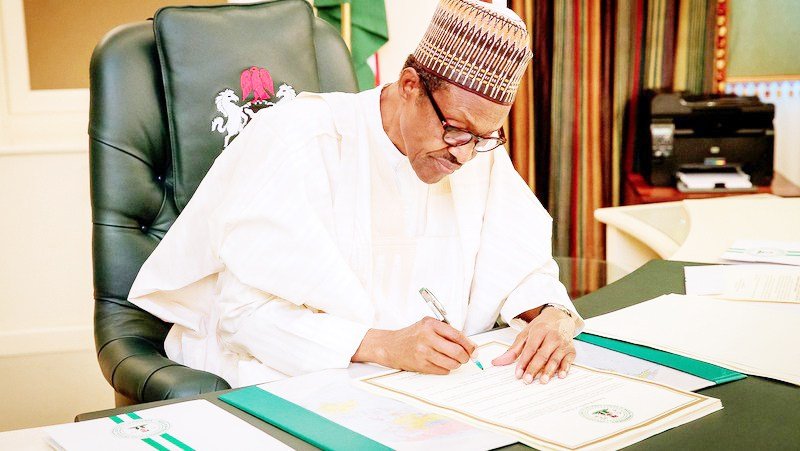

For the federal government, borrowing has become the order of the day. The Senate this week approved another $22.79 billion loan request for President Muhammadu Buhari. The loan according to government would be used for various projects domiciled with federal ministries, departments and agencies.

The country’s rising debt profile which grew from N12.6 trillion in 2015 to N16.63 trillion as at the end of 4th 2018, and then to N26 trillion at the 3rd quarter of 2019 has become a major concern for Nigerians. The current $22.7 billion borrowing would bring Nigeria’s total debt stock to $108 billion. 15 percent of this is owed by state government.

As at December 31st, 2018, the National Bureau of Statistics (NBS) put Nigeria’s foreign debt at $25.27 billion and total domestic debt was N16.63 trillion. The figure has since ballooned, and in the face of current realities, the country has no buffers.

Funds in the Excess Crude account which was $2.29 billion as of May 2015 has depleted to a mere $71.8 million, according to FAAC. In comparison Oman had $20.8 billion in its ECA equivalent account as of 2018, while Chile had $14.3 billion as of December 2019.

While the Nigerian Sovereign Wealth Fund has about $2 billion, the Norwegian SWF, the largest in the world, crossed $1 trillion in September 2017. Abu Dhabi, Kuwait, Saudi Arabia, Qatar, UAE and Libya had estimated $696billion, $592billion, $505 billion, $320 billion, $228 billion and $60 billion respectively in their SWF as of August 2019. The IMF in its Fiscal Monitor report last year listed Nigeria second from bottom in a global ranking of countries with the worst SWF management.

Meanwhile, as the debts mounts Nigeria’s capacity to service them is another area of grave concern, needless to mention its impact on the exchange rate. For example, the debt service provisions in the 2019 budget was N2 trillion, whereas the total capital budget was N2.9 trillion. The statistics is even worse with the 2020 budget where the total projected revenue can barely cover recurrent expenditure and debt servicing.

The rising profile of Nigeria’s debt has severally caused global watchers such as the World Bank and IMF to offer cautious advice. The International Monetary Fund (IMF) last year cautioned Nigeria and other developing countries about mounting loans, saying “they come with devastatingly unfavourable conditions.”

Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department of the IMF, highlighted this caution during the launch of the Global Financial Stability Report for April, 2019, at the IMF/World Bank meetings in Washington D.C., But what lessons have we learnt?.

In its recently released 2019 BER report, the Nigeria Natural Resource Charter (NNRC) found in its research that revenue volatility persists as there is little fiscal cushion available. The BER also found that government expenditure has been on an upward trajectory, with poor compliance with set MTEF benchmarks.

“The expenditure condition at the sub-national level is pathetic as most States may be plunged into further debt due to heavy reliance on statutory allocations to meet expenditure targets,” NNRC said in its findings on Precept 8, which deals with Stabilising Expenditure.

To avert a fiscal implosion, the NNRC in its Policy Brief, ‘Improving the Management of Resource Revenues for Sustainable Development’, recommended a quick passage of the Petroleum Industry Fiscal Bill, a segment of the Petroleum Industry Bill (PIB) for the purpose of enhancing the effectiveness of oil and gas laws in responding to changing global and local dynamics.

It also recommended development of the country’s statistical agency’s capacity in the collection of data on various value chain of oil and gas sector as well as the need to balance savings and consumption and financing growth in non-resource sectors of the economy.