The Nigerian Extractive Industries Transparency Initiative (NEITI) on Friday released the 2016 oil and gas industry independent audit report.

The report which detailed production and financial activities in the Nigerian oil and gas industry for the year 2016, is part of NEITI’s statutory mandate under the NEITI Act 2007 and in compliance with the principles and standards of the global Extractive Industries Transparency Initiative (EITI), which Nigeria voluntarily signed up to in 2003.

The eighth report to be produced by NEITI on the oil and gas sector, the 2016 audit was conducted by Haruna Yahaya & Co., an indigenous accounting and auditing firm. e360 analyzes the report and presents the major highlights…

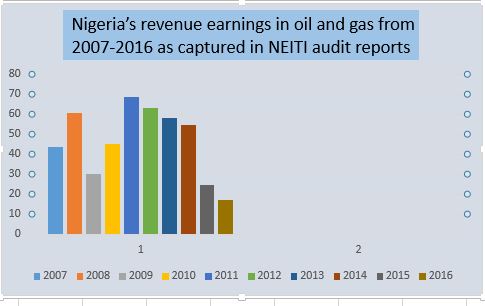

In 2016, total financial flows from Nigeria’s oil and gas sector slumped to $17.05 billion, a 31% decline on the $24.79 billion generated in 2015. A breakdown shows that the major earnings for 2016 came from export and domestic sale of Federation crude oil and gas with $7.97 billion, Petroleum Profit Tax (PPT) with $4.21 billion, and Royalty Oil with $1.57 billion.

Total crude oil production in 2016 was 659,137 million barrels as against 776 million barrels produced in 2015, a fall of 15%. Out of this; Joint Venture (JV) production accounted for 289, 174, Production Sharing Contract (PSC) 324, 071, Service Contract, 2,153, Sole Risks, 27,187 and Marginal Field 16,557mmbls.

There were 71 OMLs in production; however, only 30 produced above 5million barrels in 2016.

$8.2 billion was budgeted for cash calls in 2016, $5.5 billion was released, and $4.9 billion was paid. Non-JV cash call expenses came to $874 million, representing 17.59% of cash call expenditure.

The monthly lifting by production arrangements shows that the months of June, July, September and December witnessed the lowest volumes of crude lifted. This is attributed to the series of force majeure declared by SPDC, MOBIL and AGIP which hampered production and injection to terminals within the period.

The total gas produced in 2016 from all arrangements was 3,051,249mmscf, a decline of 6.13% from 2015 production volume. The Federation’s share of gas produced in 2016 was 27,141.95mmscf excluding NLNG purchase of 627,729.36mmscf.

The total volume of gas flared was 288,209mmscf representing 9.45% of the total gas produced. Total payments from gas flared penalty in 2016 were $8,799,411 as against $12,683,078 received in 2015 representing 30.62% reduction.

The total gas utilized in 2016 reduced marginally by 76,948.54mmscf from 2015, with a 7.73% decline. The absolute volume of unaccounted gas in 2016 was 421,006mmscf. This volume is significant when compared to the total volume of gas produced in 2016.

20 entities reported a total of 101,053,104million barrels as crude losses valued at $4.4 billion, due to sabotage and theft. SPDC and SEPLAT alone reported losses of 81,180,605.00bbls due to theft.

15 entities reported 144,398,872.51bbls as crude losses due to deferred production resulting from unscheduled shutdown of facilities and equipment.

The average monthly selling price ($) per barrel for Federation export crude oil was $43.73 in 2016.

NNPC did not use prevailing market rate to convert the sales proceeds received in US$ at the point of remitting into federation naira account. This led to an under remittance of N260.431 million.

For the first time in Nigeria’s history, crude oil produced from Production Sharing Contracts (PSCs) overtook output from the Joint Ventures (JVs). In 2016, PSCs accounted for 324 million barrels, while the JVs accounted for 289.1 million barrels, (as against the 320 million barrels for PSCs and 375.5 million barrels for JVs in 2015).

The federation share from the PSC arrangement, termed profit oil is valued at $517.373 million (11,787,617bbls of crude). The PSCs are mostly offshore, thus insulated from vandalism and sabotage, and are not constrained by adequacy/availability of equity funding by the Federation.

The total lifting for 2016 was 668.1 million barrels, as against the 780.4 million barrels lifted in 2015, a drop of 14.35%. Out of the total liftings for 2016, NNPC lifted 244.6 million barrels (36.61%) on behalf of the Federation while the companies lifted 423.5 million barrels (63.39%).

In the year under review, five JV arrangements were involved in MCA projects. The total inflow from the MCA projects was $409.734 million, with PPT constituting 73% ($299.097million) of the total inflow.

For the period under review, NLNG paid a total of $390,234,415 to NNPC as loan repayments, interest, and dividend. The dividend accruing to the Federation in 2016 was $356,126,898 representing 91.26% of the total revenues while interest and principal repayment was $2,323,733 (0.60%) and $31,783,784 (8.14%) respectively. The cumulative amount received from NLNG to date (including amounts revealed in previous audit reports 2000 – 2016) is $17,288,959,416.

Out of the 62 covered companies, 31 executed 457 non-mandatory social expenditure projects (otherwise known as CSR) valued at $160,272,148.

In 2016, the Federal Government allocated a total of 126,163.39million barrels valued at $5.48 billion or N1.37 trillion, for domestic use out of which actual refinery supply was 23,085.64 (18%), Direct Sale Direct Purchase 55,995.40 (45%), PPMC lifting (crude product exchange and un-utilized export) 36,641.60 (29%) and offshore processing 10,440.76 (8%).

In the year under review, from the proceeds of domestic crude allocation, NNPC deducted the following upfront: N512.095 billion for JV cash call, N126.554 billion for pipeline repairs and maintenance, N99.599 billion for under-recovery and N20.390 billion for crude and product losses.

The total PMS lost in 2016 was 113,470,000 Litres valued at N9, 576,799,580, while AGO recorded 645,198 litres loss amounting to N158, 073,446.

Contribution of the oil and gas sector to GDP dropped from 9.5% in 2015 to 8.3% in 2016.

The 2016 NEITI report covered 84 entities, comprising 10 government agencies, seven power generating companies, 62 oil and gas companies, three refineries, the NLNG and NGC.