Nigeria lost at least $16 billion that should have accrued as revenue from the oil and gas sector over a 10-year period of 2008 to 2017, due to the non-review of the 1993 Production Sharing Contracts (PSCs) with oil companies, e360 has learnt.

A quantitative study released in Abuja on Friday by the Nigeria Extractive Industries Transparency Initiative (NEITI) revealed the development. The study, which was done in conjunction with Open Oil (a Berlin-based extractive sector transparency group) indicates that the losses could be up to $28b if, after the review, the Federation were allowed to share profit oil from two additional licenses.

The analysis was conducted for the seven producing fields of the 1993 PSCs which include; Abo (OML 125): operated by Eni; Agbami-Ekoli (OML 127 & OML 128): operated by Chevron; Akpo & Egina (OML 130): operated by Total and South Atlantic Petroleum. Others are Bonga (OML 118): operated by Shell; Erha (OML 133): operated by ExxonMobil; Okwori & Nda (OML 126): operated by Addax and Usan (OML 133): operated by ExxonMobil.

In the publication titled, ‘‘1993 PSCs: The Steep Cost of Inaction’’, NEITI called for an urgent review of the PSCs to stem the huge revenue losses to the Federation. Such a review it said is particularly important for the federation because oil production from PSCs has surpassed production from JVs.

After compiling data from the seven offshore fields on oil production, oil prices, cost of development, operating costs, decommissioning costs, and the applicable fiscal regimes, NEITI explained that financial modelling, the standard methodology in the industry, was adopted to estimate revenue in the study.

Nigerian President, Muhammadu Buhari

The analysis was conducted by changing the fiscal regime of the 1993 PSCs (subsisting regime) to the fiscal regime of the 2005 PSCs. Three estimates were obtained relating to revenues for the 1993 fiscal regime, and two estimates relating to revenues for the 2005 fiscal regime.

The implication is that revenue would have increased from $73.78 billion to $89.81 billion if the review had simply been done using the 2005 fiscal regime. This implies a difference in revenue of $16.03 billion. Also, revenue would have increased from $73.78 billion to $102.39 billion if the review had been done using the 2005 fiscal regime and government shared in profit oil in OML 127 and OML 130 (PSA). This implies a difference of $28.61 billion.

In summary, the results showed that between 2008 and 2017, lost revenue to the Federation owing to failure to review the PSC terms was between $16.03 billion and $28.61 billion depending on which scenario one adopts.

As noted in the brief: “Between 1998 and 2005, total production by PSC companies was below 100,000,000 barrels per year while JV companies produced over 650,000,000 barrels per year’’. By 2017, total production by PSC companies was 305,800,000 barrels, which was 44.32percent of total production. Total production by JV companies was 212,850,000 barrels, representing 30.84percent of total production.”

The Deep Offshore and Inland Basin Production Sharing Contracts provided for a review of the terms when oil prices exceeded $20 per barrel. Under that provision a review should have been activated in 2004 when oil prices exceeded the $20 per barrel mark.

Although the review was not done in 2004, the judgement of the Supreme Court in October 2018 had mandated the Attorney General of the Federation to work together with the governments of Akwa Ibom, Rivers and Bayelsa States to recover all lost revenues accruable to the Federation with effect from the respective times when the price of crude oil exceeded $20 per barrel, NEITI stated in the report.

The 1993 PSC also provides that a review be activated 15 years following commencement of the PSC Act as stated in Section 16 (2) which states that: “Notwithstanding the provisions of subsection (1) of this section, the provisions of this Decree shall be liable to review after a period of 15 years from the date of commencement and every 5 years thereafter”.

At inception in 1993, the PSC terms were drawn up to incentivize and attract oil and gas companies to invest in the exploration and production of offshore fields considering the risks involved coupled with low oil prices. Thus the PSC contracts were supposedly more beneficial to the companies. However, the Law anticipates that the companies would have recouped their investments when oil price increases and after many years of operations, hence the two trigger clauses in the Act.

NEITI said in the report that, since the Supreme Court judgement has addressed the condition for the first review, this second review which should have happened in 2008, is now the focus of its Policy Brief.

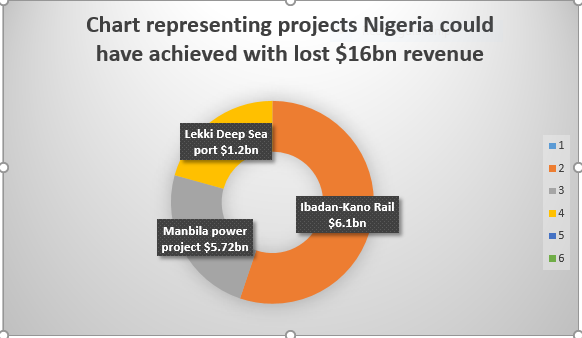

Putting the losses in project terms, NEITI said the lower threshold loss of $16.03bn to the Federation Account would have funded the Port Harcourt – Maiduguri rail line put at between $14bn to $15bn. Other projects that the lost revenue could have been used to fund include the “Mambila Power Plant of 3,050 MW at $5.72 billion, while the estimated cost of the Ibadan-Ilorin-Minna-Kano Standard Gauge Line is $6.1 billion.

The combined cost of these projects is $11.82 billion, which is less than the lower threshold of estimated losses…. the Calabar-Lagos Railine ($11 billion), Fourth Mainland Bridge ($1.4 billion), Badagdry Deep Water Port Complex ($1.6 billion), and Lekki Deep Seaport ($1.2 billion)” the Publication revealed.

It recommended that the Federal Government, through its appropriate agencies commence urgent process to review the PSC agreement with oil companies now to save the nation of continued losses.